HOW CAN WE IMPROVE CONSUMER PROTECTION IN ONLINE GAMBLING?

By Dr Robert Heirene & Associate Professor Dr Sally M. Gainsbury

Consumer protection measures for online gamblers

Compared with land or venue-based gambling, internet/online gambling involves several features that may increase the risk of harms, including constant availability, the use of digital currency and often credit, and the ability to gamble privately. Nonetheless, industry providers, regulators, and gamblers themselves potentially have a much greater opportunity to intervene and prevent harm from occurring online.

Online gambling is continuously monitored, allowing operators to detect escalating or irregular spending behaviours such as changes in volatility and bet size. Additionally, operators are uniquely placed to contact their customers about consumer protection tools.

Consumer protection tools allow customers to direct their own harm-minimisation efforts and are relevant for all players to prevent the occurrence or escalation of harms. Customers can temporarily deactivate their accounts using the time-out or “take a break” feature, or permanently close them via self-exclusion. They can set limits (or “pre-commitments”) on the amount of money they are able to deposit into their online account (“deposit limits”) or lose (“loss limits”). Online activity statements allow customers to track their expenditure over time.

Finally, operators can provide customers with access to “responsible gambling” information pages and the contact details of support helplines. Many of the consumer protection tools made available by online gambling operators are part of licensing requirements; however, some operators have taken innovative steps to be more proactive in their attempts to develop and implement more effective resources to minimise harms.

Voluntary uptake of consumer protection tools is low

When they’re asked in survey studies, most online gamblers report positive perceptions of tools like deposit limits, activity statements, and time-outs. However, there’s a disconnect between the number of people who say these tools are useful and the number who actually use them. For example, one study found 70% and 42% of Svenska Spel (a Swedish online gaming company) customers rated deposit limits and self-exclusion features as useful, respectively. Yet, actual rates of use are much lower. Among Australian wagerers, 88.4% report using activity statements, although only 24.5% and 8.1% say they have used limits and timeouts, respectively. In the UK, the Gambling Commission’s 2019 survey of 6,425 gamblers found rates of 9% for limit setting, 3% for time outs, and 2% for self-exclusion from specific products.

Are these tools effective?

So far, preliminary evidence suggests the answer to this question is a cautious yes—certain consumer protection tools appear to be effective at reducing harm. However, the evidence is inconsistent and the field is limited due to few methodologically-robust studies.

The most support exists for deposit limits. One study with a European operator found that customers who set deposit limits reduced the number of days they place bets, their betting frequency, and the overall amount they gamble. Among the most “intense” gamblers, setting limits has been linked to reduced gambling intensity and expenditure. However, a recent study in Finland found limit setting had no effect on overall net loss.

Little is known about the harm-reducing effects of activity statements and time outs other than the finding that gamblers typically view them positively. Most online gamblers report using activity statements and many say they help them stick to their budgets; although there have been concerns raised that viewing lost bets in activity statements could lead to loss chasing.

How to increase the uptake of consumer protection measures online

Despite the preliminary research many questions remain unanswered. How can we increase the uptake of consumer protection tools? Can they reduce gambling harms long-term? Who benefits most from using them? And how can we increase use within this cohort?

These questions are the foci of the research being undertaking at the Gambling Treatment and Research Clinic.

This research has sought to understand the motivations for using consumer protection tools among customers of online wagering providers in Australia. Among the 564 customers surveyed, the most commonly reported reasons for using the various tools were to:

- feel in control of gambling,

- see personal transaction histories (activity statements),

- limit gambling expenditure (deposit limits), and

- take a break from gambling (timeouts).

In the same cohort, predictors for future tool use included:

- previous use of the tools,

- positive attitudes towards them, and

- positive subjective norms (i.e., a belief that others use the tools and find them useful)

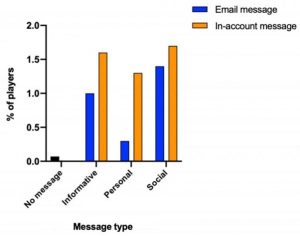

As a next step, the researchers sought to influence the behaviour of users through the use of direct messages in a live trial to encourage limit setting. The initial findings from one (of four) operators are presented in Figure 1 below. Overall, around 1.3% of the 10,000 customers from this operator set a deposit limit within five days of viewing their message.

After accounting for the low opening rate of messages (~29%), this rises to 4.5% of customers. So far, the only clear finding regarding message type is that messages sent via in-account notification were more effective promoting limit setting than messages sent via email (although this may change after we receive the results from other operators).

Figure 1. The percentage of players who set a limit after receiving messages promoting deposit limits (Heirene & Gainsbury, 2020)

Figure legend: All messages were sent to customers of an online wagering site by the operator and customers were unaware that the messages were sent as a part of a study and that their response was tracked.

Informative message: “Our customers are able to set a personal limit on the amount of money deposited into their gambling account using the Deposit Limits tool, for a 24 hour, weekly, two weekly, or monthly period”

Personal message: “Deposit limits are a great way to manage your spending”

Social message: “Most people who use deposit limits find they help them manage their spending”

So, what do these findings tell us?

Well, while only a small proportion of players set limits in response to messages, the simplicity and negligible cost of this strategy makes it worthy of wider implementation. If the rate of 4.5% extrapolates, these simple messages could potentially result in thousands of online gamblers choosing to set limits, particularly if delivered directly to players via in-account notification.

The next step in this research is to investigate the effects of sending more targeted messages. Research shows groups of gamblers (e.g., younger vs. older) have different preferences for message types, suggesting tailored messages could be more effective in promoting the use of consumer protection tools.

Another, perhaps even simpler strategy for increasing limit use is default opt-in, which has been implemented recently in Australia as a result of the National Consumer Protection Framework for online wagering. All Australian wagering sites now require their customers to either set a deposit limit or opt-out of setting one upon registration in order to gamble (all existing customers were prevented from gambling further until they had done the same).

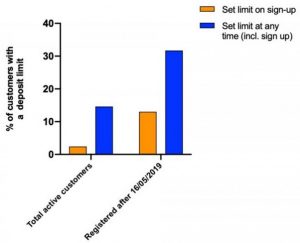

Some preliminary data on the effects of this change from one online operator are presented below in Figure 2. These show that, even though existing customers who had registered before the date this strategy was brought into effect (16/05/2019) were also required to set a limit or opt-out, those who registered after its implementation were substantially more likely to set limits. This suggests there may be greater propensity for people to set limits if asked early on (i.e., on registration).

Figure 2. The percentage of wagering customers from one Australian site who have set a deposit limit as of 15/10/2019

Figure legend: Left two bars represent the percentage of all customers who set limits on sign-up (orange) and at any time (blue) up to 15/10/2019. Right two bars represent customers who registered on or after 16/05/2019 when the need to opt-out of limit setting become mandatory on sign up. Bars represent the percentage of customers who set limits on sign-up (orange) and at any time (blue) between 16/05/2019 and 15/10/2019.

Note: the overall proportion of players who use deposit limits with this operator is 14.6% (left blue bar), substantially less than the 24.5% self-reported by Australian wagerers in Gainsbury et al. (2019).

The role of regulators

Regulators have an important role to play in protecting consumers online and minimising gambling-related harms. Based on the evidence discussed here, there are some novel strategies regulators could incorporate into policy to help them achieve this.

First, requiring online sites to regularly inform their players of the consumer protection tools available to them could lead to greater uptake. Short, easy-to-read messages sent via in account notifications seem most useful for this purpose, ideally linking directly to the tool. Research has shown most problem and non-problem gamblers do not report being inconvenienced by the promotion of consumer protection tools, so proactive messaging is unlikely to irritate customers.

Second, regulators could require that operators ensure all of their customers set a deposit limit or opt-out of setting one, ideally upon account creation. Requiring customers to set their own limit (or opt-out) will allow them to consider how they should tailor the limit amount to their own gambling preferences and financial situation.

Overall, the consumer protection measures available to online gamblers show some promise as simple tools for supporting customers to gamble sustainably. Moving forward, more research is needed to understand how we can best utilise these tools to reduce harms, including the “who” and “when” of their implementation. However, ultimately it will be up to regulators to stay abreast of this research and translate the findings into actionable regulations to guide industry operators.

Authors:

Dr Robert Heirene

Email: robert.heirene@sydney.edu.au

Address: Gambling Treatment & Research Clinic, Brain and Mind Centre, University of Sydney, 94 Mallett St, Camperdown, Sydney, NSW, Australia, 2050.

Website: https://robheirene.netlify.com

Associate Professor Dr Sally M. Gainsbury

Email: sally.gainsbury@sydney.edu.au

Address: Gambling Treatment & Research Clinic, Brain and Mind Centre, University of Sydney, 94 Mallett St, Camperdown, Sydney, NSW, Australia, 2050.

Website: https://www.sydney.edu.au/science/about/our-people/academic-staff/sally-gainsbury.html